There are an estimated 7,000 rare diseases worldwide for which there is no current treatment, affecting up to 30 million people in Europe and 300 million people wordwide.1 “Rare diseases are not so rare” is indeed a suitable slogan repeated by advocates throughout the world to highlight the collective importance of this group of diseases.2

When exploring individual treatments, the rarity of rare diseases is a challenge. Rare diseases affect a small proportion of the population (<1/2,000 people in Europe), usually from birth or childhood, and are often severe.3 With such small populations, gathering disease knowledge and raising awareness can be a challenge with rare diseases.

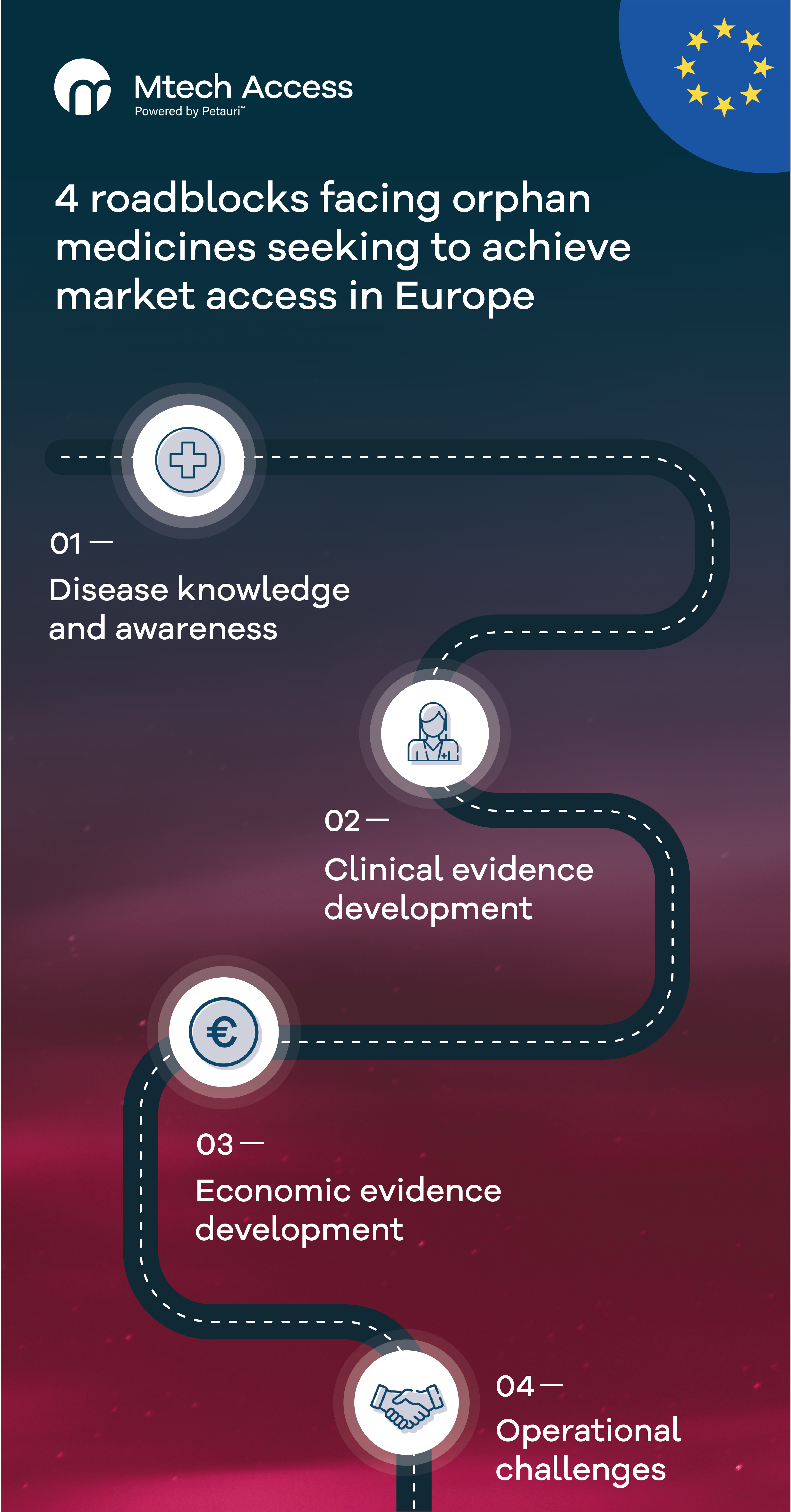

Any medicine or device should have a pricing and market access strategy that is underpinned by a good understanding of the target patient population, including the current and anticipated future treatment pathway, epidemiology, patient subgroups and severities, and unmet needs. Consequently, gathering disease knowledge and raising awareness of patients’ needs is the first hurdle facing manufacturers looking to launch an orphan medicine or orphan device.